One of the most long-lived of all investment newsletters, Investment Quality Trends has been making money for its subscribers since 1966, following the wonderfully old-fashioned idea that one should purchase the top dividend-paying

stocks when the dividend yield is historically high, sell when the dividend yield declines to historic lows and completely avoid stocks which pay no dividend at all.

The purpose of this Tutorial is to familiarize you with the Newsletter culture, language, basic concepts and contents. (40 minutes)

In this Tutorial I cover the philosophy of Value investing from the IQ Trends perspective, why dividend paying stocks are the best vehicle for realizing return on investment, a review of the Criteria for Select blue Chips, and the Dividend Yield Theory. (29 minutes)

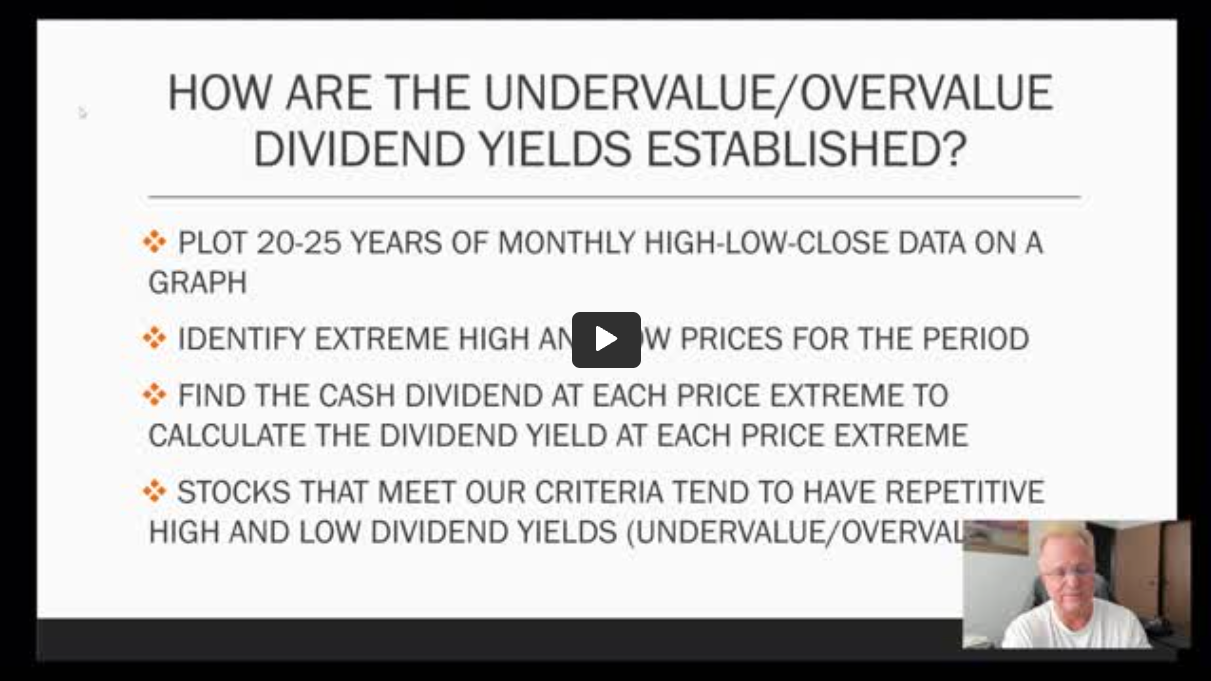

Why stock charts are important. The common features of all charts. What makes IQ Trends charts different. How the Undervalue/Overvalue are are identified.

(26 minutes)

Yes, dividends! The simple fact is that the top dividend-paying stocks provide a cushion of safety in a turbulent market environment and most particularly, when stock prices start going down. The top dividend-paying

stocks also tend to trade between distinct high-yield (undervalue) and low-yield (overvalue) price areas, which identify where investors should buy and sell. In addition to providing income and safety, the top dividend-paying stocks

show investors when to buy, sell, or hold according to historically repetitive patterns of dividend yield!

But be careful! The top dividend-paying stocks doesn’t mean the highest-yielding stocks. The top dividend-paying stocks are the highest quality dividend-paying stocks, which have long track records of profitability, at least 25 years of uninterrupted dividends with a consistent pattern of increasing dividends, liquidity, institutional sponsorship, and managerial competence.

While our approach to investing is simple, it is logical, low-risk and consistently profitable. Our approach has also earned the highest rankings from The Hulbert Financial Digest for risk-adjusted returns and the respect of the global- investing community as the independent source for timely information on the top dividend-paying stocks.

Our approach has garnered the confidence and patronage of the professional financial community and we are honored to count them among our subscribers. While it is a high privilege to assist many of the leading investment banks and trust companies, mutual funds, investment managers, and brokerage firms, we have enjoyed a long association with the serious, private investor that appreciates our passion for: the preservation of capital, an immediate return on investment from dividends, and a growing income stream from dividend increases, and the harvesting of capital gains when appropriate.

We identify and analyze the 250 top dividend-paying stocks for Undervalue (our buying discipline) and Overvalue (our selling discipline) prices and publish detailed statistical information twice a month, categorizing the stocks with Buy, Sell, Hold, and Ignore recommendations. Each issue includes: cogent commentary in the Investment Outlook, four proprietary charts that offer unique insights into stocks of current interest, and our ten best Undervalued ideas of the moment in The Timely Ten.

For questions or comments, please e-mail us at: info@iqtrends.com or call: 866-927-5250.

We love to hear from our subscribers so reach out any time. Kelley will answer your emails and calls personally. Send to subscribers@iqtrends.com.